Hello! How can I help you today?

Buying or selling a home is more than just a transaction; it’s a significant life event! But amidst the excitement, it’s crucial to understand the legalities that protect your investment, such as title insurance. Whether you’re a seasoned realtor, a first-time homebuyer, or a seller, understanding title insurance and the closing process is critical to a smooth experience. At Setco, we’re here to guide you through every step of the closing process, ensuring your real estate journey is as seamless and stress-free as possible. Let us help turn your closing day into a celebration of new beginnings!

Title insurance might not be the glamorous part of buying or selling a home, but it’s one of the most important. When you purchase real estate, you obtain a title—the legal right to own and use the property. Title insurance protects you (and your lender) from any potential legal issues that might arise from defects in that title.

Owner’s title insurance is crucial as it safeguards your ownership rights. This protection is invaluable, covering risks like undiscovered liens, fraud, or even clerical errors in public records.

So, what does Setco do? In short, a title company ensures that the property you’re buying or selling has a clear title and is free of legal entanglements. We conduct a thorough title search, digging into public records to verify the seller’s legal right to transfer ownership and uncover potential issues, such as unpaid taxes or unresolved disputes.

However, more than a title search is required to cover everything. That’s where a municipal lien search comes in. While a title search focuses on recorded documents—such as liens, mortgages, taxes, and foreclosures—a municipal lien search uncovers unrecorded issues that might not appear in the title search. These can include unpaid utility bills, code violations, and permitting issues, which could become your responsibility if not addressed before closing.

At Setco, we perform a municipal lien search on every property to ensure no surprises after closing, giving you extra peace of mind during the transaction. This step is crucial because title insurance does not cover the issues a municipal lien search uncovered. Title insurance protects against defects in the recorded title history but won’t cover unrecorded municipal matters. By conducting both a title search and a municipal lien search, Setco provides a more comprehensive review, protecting you from unforeseen liabilities and ensuring that your real estate transaction proceeds smoothly.

We go beyond just performing the actual property searches. Setco also manages the closing process, coordinating with all parties to prepare and finalize the necessary documents, disburse funds, and ensure that everything complies with the contract. Plus, with our Qualia Connect system, you can monitor every step of the process in real-time, giving you peace of mind and complete transparency.

The journey to closing begins with finding your dream home! After this, the price and closing costs are negotiated, and once the contract is signed, it’s submitted to Setco. The next step is securing your contract by paying your earnest money. At Setco, we make this easy with options like electronic deposits, ensuring your earnest money is handled securely. We then set up your transaction in Qualia Connect so you can track your closing process as it happens.

Note for Sellers: Address any potential title issues before listing your property.

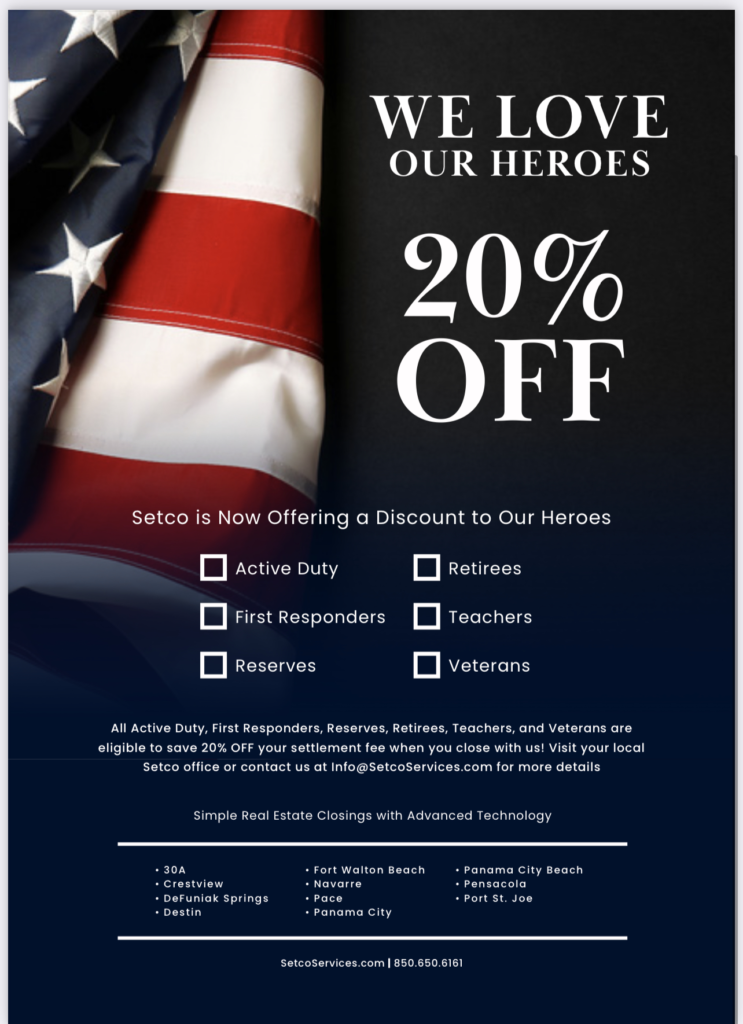

Note for those who pay the title: Setco offers a 20% discount on our settlement fee to all military personnel, first responders, and teachers! It would help if you let your realtor and Setco know at this point. We are proud to support our heroes!

Once we receive the contract, Setco orders the title search to ensure the property’s title is clear. We then collaborate with your realtor to fulfill the lender’s requirements, including obtaining a termite inspection, appraisal, or survey. Setco coordinates with all relevant parties as the closing date approaches to prepare the necessary paperwork, including collecting HOA information and calculating property tax prorations.

We’re ready to move forward once we receive the final clearance to close from our underwriter, Fidelity National! The property officially changes hands at this stage, with all documents signed and funds disbursed. We’ll work with you to schedule a closing appointment that suits your needs, whether you prefer to visit our office or have your documents mailed for signing and notarization. We can also arrange a mobile notary service to assist you if needed.

If you choose to come into our office, our team will be ready to welcome you on closing day! To make the occasion even more unique, we celebrate by giving both our sellers and buyers a bottle of champagne—because every closing should celebrate new beginnings!

Even after the closing, Setco’s work isn’t done. We record the deed with the appropriate county to reflect the change in ownership. Payments are then disbursed to all parties, such as realtors and inspectors. Within 45 days, you’ll receive your post-closing documents and policy, accessible through Qualia Connect for easy reference.

Essential Reminders for Buyers:

Title issues can be a significant roadblock in a real estate transaction, but with the proper preparation, many of these problems can be avoided:

By working with Setco, you can identify and resolve these issues before they become significant problems, ensuring a smoother closing process.

Navigating the complexities of title insurance and the closing process is more straightforward with the right partner by your side. At Setco, we ensure your transaction is as smooth as possible. If you have any questions or need guidance, please contact us.

Visit our website here to learn more about our services, or contact us directly to see how we can assist you in your real estate journey!